A ponzi scheme is thought about a deceptive investment program. It involves using payments gathered from brand-new investors to pay off the earlier financiers. The organizers of Ponzi schemes typically promise to invest the cash they collect to produce supernormal earnings with little to no danger. Nevertheless https://cle.cobar.org/About/Faculty-Authors/Info/CUSTOMERCD/295003, in the real sense, the fraudsters don't really prepare to invest the cash.

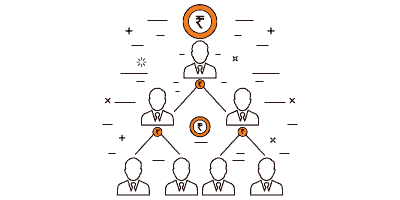

When the new entrants invest https://twitter.com/TysdalTyler/likes, the cash is gathered and utilized to pay the initial investors as "returns."Nevertheless, a Ponzi scheme is not the like a pyramid scheme. With a Ponzi scheme, investors are made to believe that they are earning returns from their investments. In contrast, participants in a pyramid scheme know that the only method they can make earnings is by hiring more people to the scheme.

Warning of Ponzi Plans, A lot of Ponzi plans included some typical attributes such as:1. Guarantee of high returns with minimal threat, In the real life, every investment one makes brings with it some degree of threat. In fact, investments that provide high returns normally bring more threat. So, if someone offers an investment with high returns and couple of dangers, it is likely to be a too-good-to-be-true offer. https://twitter.com/TysdalTyler/with_replies

Ponzi Scheme Dogecoin

2. Excessively consistent returns, Investments experience fluctuations all the time. For example, if one purchases the shares of a given company, there are times when the share price will increase, and other times it will reduce. That stated, financiers need to constantly be hesitant of investments that produce high returns regularly no matter the fluctuating market conditions.

Unregistered financial investments, Prior to rushing to purchase a scheme, it is necessary to validate whether the investment firm is registered with U.S. Securities and Exchange Commission (SEC)Securities and Exchange Commission (SEC) or state regulators. If it's signed up, then a financier can access details regarding the company to figure out whether it's legitimate.

Unlicensed sellers, According to federal and state law, one should possess a particular license or be signed up with a controling body. A lot of Ponzi plans deal with unlicensed individuals and business. 5. Deceptive, sophisticated methods, One need to prevent investments that include procedures that are too complicated to understand. History of the Ponzi Scheme, The scheme got its name from one Charles Ponzi, a fraudster who duped countless investors in 1919.

Why Are Ponzi Pyramid Schemes Illegal

In the past, the postal service provided global reply vouchers, which made it possible for a sender to pre-purchase postage and incorporate it in their correspondence. The recipient would then exchange the discount coupon for a concern airmail postage stamp at their house post office. Due to the variations in postage prices, it wasn't uncommon to discover that stamps were more expensive in one country than another.

He exchanged the coupons for stamps, which were more pricey than what the discount coupon was originally bought for. The stamps were then cost a higher rate to earn a profit. This kind of trade is referred to as arbitrage, and it's not unlawful. However, at some point, Ponzi became greedy.

Given his success in the postage stamp scheme, no one questioned his intents. Regrettably, Ponzi never ever really invested the money, he just raked it back into the scheme by settling some of the financiers. The scheme went on until 1920 when the Securities Exchange Company was examined. How to Secure Yourself from Ponzi Plans, In the very same method that a financier looks into a company whose stock he's about to buy, a person should investigate anyone who assists him manage his financial resources.

Ponzi Scheme Atlanta

Also, prior to buying any scheme, one ought to request the company's financial records to confirm whether they are legit. Secret Takeaways, A Ponzi scheme is just an illegal investment. Called after Charles Ponzi, who was a fraudster in the 1920s, the scheme promises consistent and high returns, yet allegedly with very little risk.

This type of scams is named after its developer, Charles Ponzi of Boston, Massachusetts. In the early 1900s, Ponzi introduced a scheme that guaranteed financiers a 50 percent return on their investment in postal coupons. Although he was able to pay his initial backers, the scheme dissolved when he was not able to pay later investors.

What Is a Ponzi Scheme? A Ponzi scheme is a deceptive investing scam appealing high rates of return with little threat to investors. A Ponzi scheme is a deceitful investing scam which produces returns for earlier investors with money taken from later financiers. This is similar to a pyramid scheme because both are based on using new investors' funds to pay the earlier backers.

Ponzi Scheme For One

When this circulation goes out, the scheme falls apart. Origins of the Ponzi Scheme The term "Ponzi Scheme" was coined after a trickster named Charles Ponzi in 1920. Nevertheless, the very first recorded instances of this sort of investment fraud can be traced back to the mid-to-late 1800s, and were managed by Adele Spitzeder in Germany and Sarah Howe in the United States.

Charles Ponzi's original scheme in 1919 was concentrated on the US Postal Service. The postal service, at that time, had developed international reply discount coupons that enabled a sender to pre-purchase postage and include it in their correspondence. The receiver would take the coupon to a regional post office and exchange it for the top priority airmail postage stamps needed to send out a reply.

The scheme lasted until August of 1920 when The Boston Post started investigating the Securities Exchange Business. As a result of the paper's investigation, Ponzi was jailed by federal authorities on August 12, 1920, and charged with several counts of mail fraud. Ponzi Scheme Red Flags The concept of the Ponzi scheme did not end in 1920.

Why Are Ponzi Pyramid Schemes Illegal

Tyler Reports on Online

Kind of financial scams 1920 picture of Charles Ponzi, the namesake of the scheme, while still working as an entrepreneur in his workplace in Boston A Ponzi scheme (, Italian:) is a kind of scams that draws investors and pays profits to earlier financiers with funds from more current investors.